Learn about budgeting, saving, getting out of debt, credit, investing, and retirement planning. Not a fast turn around, but you should be good by the filing date.

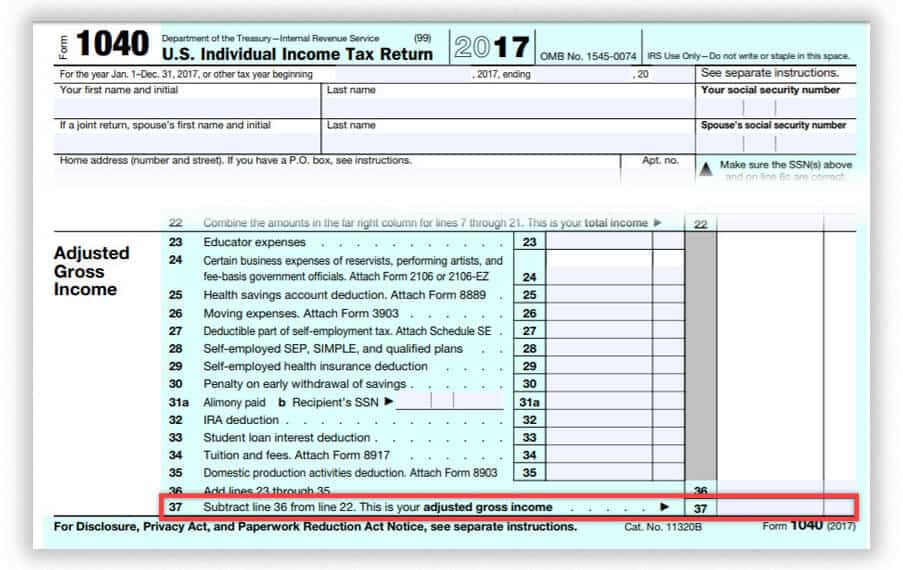

If you've filed your 2020 taxes and they've been processed, that number will be used.Ĭompare your AGI to the numbers above to see whether or not you'll qualify for a check. You can request a tax tanscript by mail from the IRS to get her AGI. If you've not yet filed your 2020 taxes, the AGI from your 2019 tax form will determine eligibility. Your stimulus check eligibility will be determined by the AGI on your latest tax return. Specifically, it's on line 8b of your 2019 tax return. Your AGI is relatively easy to find - it's listed on your annual tax return. Look on your latest tax return to find your AGI

#AGI FROM LAST YEAR FULL#

Here are the income limits you'll need to fall within in order to receive the full $1,400 per person in your household (including children and dependents): Only those earning less than a specific AGI will be eligible for a full stimulus check. But it's taken on a special new role as a qualifier for stimulus checks since the start of the pandemic.

#AGI FROM LAST YEAR VERIFICATION#

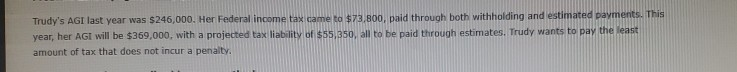

They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. Your AGI is a pretty important number generally: It determines whether you qualify for a number of deductions and tax credits, and you need it to file your taxes. Taxpayers can complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail. Read on for our six biggest reasons why $25 is a steal for the experience.Eligibility for the stimulus check will be based on your AGI and filing status Why Should I Pay to File My Own Taxes? 6 Reasons It's Worth It Use our handy online calculators to see what your costs will be - and what your costs will be for health insurance - and what your penalty might be if you don't have it. Adjustments include deductions for conventional IRA. What Do Clean Water and Online Taxes Have in Common?īoth and Healing Waters International take the basics to the next level. Your total (or gross) income for the tax year, minus certain adjustments youre allowed to take. Readįiling your taxes online is actually the safest way to handle your tax return, according to the IRS.

ReadĬonfused about e-filing your taxes? Speed up your return filing with these tax tips. Heard the online banking buzz? Though traditional banks have their strengths, let's see what this online bank trend has to offer.

#AGI FROM LAST YEAR HOW TO#

Some common mistakes on income tax returns - and how to avoid them. ReadĮ-filing is the safest way to handle your taxes. Here's what we found in our blog for file online with :Ĭheck our tax calendar to see exactly when your taxes are due.

0 kommentar(er)

0 kommentar(er)